- #Lightspeed onsite cusomize statments full

- #Lightspeed onsite cusomize statments series

- #Lightspeed onsite cusomize statments free

I would imagine we see something similar like this for retail as well in the future and these offering rolled out to global Lightspeed customers. Hard to not get excited by that color in my view.

And there’s a big opportunity here for - to go and grab it. And let’s now forget that the majority of this market is on legacy systems still. So we feel the market is up for grabs right now. There’s a lot of current restauranteurs who are opening new facilities. We feel that the combination of everything that we’re putting together is going to be very unique in the market. We have, today, Upserve and Lightspeed that serve that market, but we’re very bullish and excited about this launch. We believe that’s going to be an extremely competitive product for the market.

#Lightspeed onsite cusomize statments series

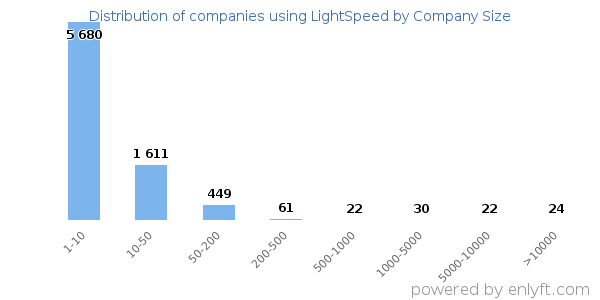

And really, that product is going to be a combination of Lightspeed Payments, the K Series POS, the ingredient management, and the advanced analytics platform, and that is due to be launched by the end of the summer in the U.S. that’s going to be called K Series, which is our flagship. Some color from Lightspeed’s recent earnings call on this:Īs you know, we’ve been working toward the launch of our product in the U.S. This strategy will culminate together when Lightspeed launchers their K-Series by the end of Summer in USA. To begin with the back-office suite, this is one that has seen the most progression over the years, mostly from acquiring different companies and bundling their best tech together while still letting some of them operate as standalone businesses still like Upserve, NuOrder & Shopkeep for examples. Here is a chart showing Lightspeeds change in market cap since August 2019, where it now sits at 18.7B (sitting at a fresh all time high) while reaching a low of 1.1B at the pandemic bottom in March 2020:Īs shown above, you could break Lightspeed’s product offerings into three main buckets: For the NYSE IPO, underwriters included Morgan Stanley, Barclays & BMO as joint lead book-running manager, while BofA and RBC were joint-bookrunners, and CIBC, KeyBanc, Raymond James, Scotiabank, TD and Truist were co-managers. Lightspeed then IPO’d on the New York Stock Exchange at a $5.9B valuations raising $332M in gross proceeds in September of 2020. Lightspeed Commerce is a dual listed company, where they first IPO’d on the Toronto Stock Exchange (TSX) at a $1.4B valuation raising $240M CAD or about $111M USD in May of 2019. Founded in 2005 by CEO Dax Dasilva in Montreal, Canada, Lightspeed started out as an iPad point-of-sales (POS) operating system (OS) that has evolved quite a bit since then into a cloud-based ecosystem. Lightspeed Commerce, formerly known as Lightspeed POS, is a one-stop-shop for all things commerce in the retail, restaurant and golf spaces. Our solutions equip independent businesses with the technology required to transform the way they manage their operations and exceed consumers’ expectations in this changing environment. Consumer behaviors and expectations are changing, fueled by the influence of new technologies pushing consumers towards an omni-channel experience. Running an independent business, however, is becoming increasingly complex. We believe cities and communities are built on the presence and success of local SMBs and that these businesses are integral to the vibrancy of their communities. Let’s start it off with Lightspeed’s mission statement from their S-1:Īt Lightspeed, our mission is to bring cities and communities to life by powering small and medium-sized businesses (“ SMBs ”).

#Lightspeed onsite cusomize statments free

Now lets do this! This is a long read so feel free to skip around to different areas that interest you more than others, I won’t be offended. None of the opinions portrayed are intended as financial advice. The only way I’ll get better at these is by starting somewhere, compounding knows no bounds of application! I’m open to all feedback on the style and format of the deep dive.

Big reason why I’ve only decided to do one of these per quarter so I can make sure I do a decent job (hopefully).

#Lightspeed onsite cusomize statments full

This is a company I’m really excited about and - full disclaimer - is my largest position currently.ĭoing these kinds of newsletters is slightly out of my comfort zone due to so much to cover and convey with “deep dives” and wanting to do the best job balancing word jumbles and non value added regurgitation of investor decks etc.

Link for viewing this newsletter in separate windowįor my first deep dive newsletter, I’m going to be discussing Lightspeed Commerce, the Montreal-based one stop shop for all things commerce.

0 kommentar(er)

0 kommentar(er)